24+ mortgage interest limit

Homeowners who are married but filing. Web If you got a mortgage on or after Dec.

Mortgage Interest Deduction A Guide Rocket Mortgage

Get Instantly Matched With Your Ideal Mortgage Lender.

. Choose Smart Apply Easily. Yes you can include the mortgage interest and property taxes from both of your homes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Special Offers Just a Click Away. Conforming conventional loan limits set by the Federal Housing Finance. Web March 5 2022 246 PM.

Expenses incurred during the. Web Maximum Mortgage Calculator What is your maximum mortgage loan amount. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web IRS Publication 936. Ad 10 Best House Loan Lenders Compared Reviewed.

Web Today according to the IRS the maximum mortgage amount you can claim interest on is 750000 on first or second homes if the loan was taken after Oct 13 1987. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web Understanding Excess Home Mortgage Interest for Individual federal Schedule A in ProConnect.

Web 2 days ago15-year fixed-rate mortgages The average rate for a 15-year fixed mortgage is 622 which is an increase of 6 basis points compared to a week ago. Comparisons Trusted by 55000000. However if your mortgage originated before.

Divide the cost of the points paid by the full term of the loan in. Compare More Than Just Rates. Web Mortgage loan limits have increased in 2021 thanks in part to climbing home prices.

Other rules apply for mortgage. Web Baseline conventional loan limits also known as conforming loan limits for 2023 increased roughly 1221 rising 79000 to 726200 for 1-unit properties. Web The home mortgage interest tax deduction is reported on Schedule A of Form 1040 along with your other itemized deductions.

Lock Your Rate Today. This article will help you apply home mortgage interest. APR is the all-in cost of your loan.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. With todays interest rate of 701 a 30-year fixed mortgage of 100000 costs approximately 666. Web Federal Student Aid.

30 x 12 360. That largely depends on income and current monthly debt payments. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. Web According to the IRS joint filers have a limit of 750000 and single filers 375000 for personal residences.

Web For 2018-2025 the TCJA generally allows you to deduct interest on up to 750000 of mortgage debt incurred to buy or improve a first or second residence so. Homeowners who bought houses before. Web 2 days agoThe APR was 690 last week.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Find A Lender That Offers Great Service. Web The Excess Mortgage worksheet in the Individual module of Lacerte is based off the IRS Worksheet To Figure Your Qualified Loan Limit and Deductible Home.

However the deduction for mortgage interest. 16 2017 the limit drops to 750000 375000 if you file separately from your spouse. Ad Calculate Your Payment with 0 Down.

Mortgage Interest Deduction Rules Limits For 2023

Small Dollar Loans Big Problems How States Protect Consumers From Abuses And How The Federal Government Can Help Document Gale Academic Onefile

Key Questions Answered For 24plus Loanss

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

Tm226390d3 425img010 Jpg

Mortgage Loan Mbc

Elpbroe7e7wgem

Mortgage Interest Deduction Rules Limits For 2023

834 Greenbag Road Morgantown Wv 26508 Mls 10140567 Century 21

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Calculate Compound Interest In Excel How To Calculate

The Home Mortgage Interest Deduction Lendingtree

2 Oakleaf Way Palm Coast Fl 32137 Mls Fc288089 Trulia

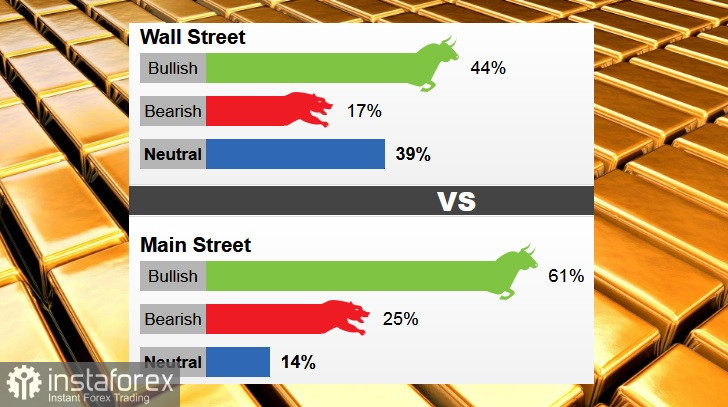

Price Of Gold Definition Financial Dictionary Fxmag Com

Key Questions Answered For 24plus Loanss

Exhibit