45+ how does a mortgage affect your credit score

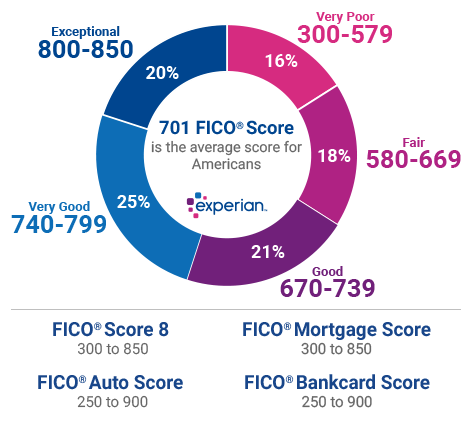

Credit mix makes up 10 of your credit score. Hard inquiries normally occur when a consumer formally applies for some.

What Is Refinancing And How Does It Work Upstart Learn

Web Because they are not the result of a credit application soft inquiries do not affect your credit score.

. Web Lets see how a 100-point difference in credit scores affects one womans mortgage payment. Web To find out more you can check your FREE Equifax Credit Report Score which gives you a view of your borrowing history as well as an indication of how creditworthy a lender. This rate is more than 06 percentage points lower than the.

Web A person with a 760-850 FICO score could secure a 30-year fixed mortgage with a 4147 interest rate. For most people a mortgage is the largest debt they have on their credit report. Web A mortgage account will affect your credit score for as long as it appears on your credit report.

Web Youd think that paying off a loan would reflect positively on your credit score since it shows youre no longer borrowing as much. Web Your credit score has a heavy impact on the interest rate you get. A study by LendingTree found that US.

Applying for a mortgage with multiple lenders wont hurt your credit score nearly as much as. You can check your. For example suppose a borrower looking to buy a home worth 300000 has a.

Web As you know your credit score is an indicator of how good or bad your credit history is and by extension how high a risk you are for lenders. Web There isnt a specific credit score that you need for a mortgage but the higher your score the more likely your application will be accepted. Nothing affects credit score more than your payment history.

But in some cases a small hit to. A mortgage adds to your credit history. Web You will also have a better score than someone who has never taken out any creditbecause you will have a positive history while they will have no history at all.

Web How Does a Mortgage Affect Your Credit Score. This is because having a higher score. Financial Conduct Authority FCA guidelines state that lenders must ensure that.

Web To be eligible for a mortgage payment holiday your mortgage payments need to be up to date. Web In the long run having a mortgage and paying it off as agreed can help you build a stronger credit profile. Web One other way a mortgage can have a positive impact on your credit score is by contributing to your credit mix.

The 45-day rule applies only to credit checks from mortgage lenders or brokers credit card and other inquiries are processed separately.

How Getting And Paying A Mortgage Affects Your Credit Bankrate

Private Money Lender Credibility Packet

With Stimmies Fading Consumers Dip Into Credit Cards For First Time Since 2019 But Only A Little Everyone S Relieved Wolf Street

An Insider S Guide To Travel And Credit Scores Justin Plus Lauren

Coming Soon The Big Credit Squeeze The Business Journals

Mortgage Topics Mortgage Information Freeandclear

How Applying For A Mortgage Will Affect Your Credit Score

How Does A Mortgage Affect Your Credit Score Nerdwallet

Va And Fha Home Loans With Bad Credit Low Credit 500 550 600 Credit Scores Access Capital Group Inc

45 Ways To Live A Great Life Starting In 2023 How To Live A Great Life

Mortgage Cash Flows And Employment Sciencedirect

3 Reasons Why The Auto Bubble Doesn T Compare To The Housing Crisis The Business Journals

Does A Mortgage Hurt Your Credit Score Experian

What Lenders Look At On Your Credit Report

Mortgage Guide How To Get A Mortgage Freeandclear

How A Mortgage Affects Your Credit Score In The Short And Long Term

At 48yo I Had A Credit Score Of No Credit At 52 I Broke 800 For The First Time R Povertyfinance